Once upon a time, in the United States in 1923, a group of important leaders and businessmen met at the Edgewater Beach Hotel in Chicago – curiously, six years prior to the Stock Market Crash of 1929. Among them were the owners of the largest steel and gas company, the man who headed the New York Stock Exchange and even a member of President Harding’s Cabinet.

However, within the span of twenty-five years, nine of these individuals faced devastating outcomes. Some were rendered bankrupt, others incarcerated, and tragically, a number succumbed to despair, ending their lives.

Why Teach Financial Literacy?

Reflecting on the tragic fates of these leaders, Kiyosaki conveys his concern that many individuals place too much emphasis on money, overlooking their most invaluable asset: education. “If people are prepared to be flexible, keep an open mind and learn, they will grow richer and richer despite tough changes,” the author asserts, but “if they think money will solve problems, they will have a rough ride.” Money, when unaccompanied by financial intelligence, tends to vanish. What truly matters is not how much you earn, but how much you hold. This pattern is evident in the stories of many lottery winners, who seemingly achieve wealth overnight, only to find themselves back where they started just as quickly.

Assets vs Liabilities

Rule number one: You must know the difference between an Asset and a Liability, and buy Assets.

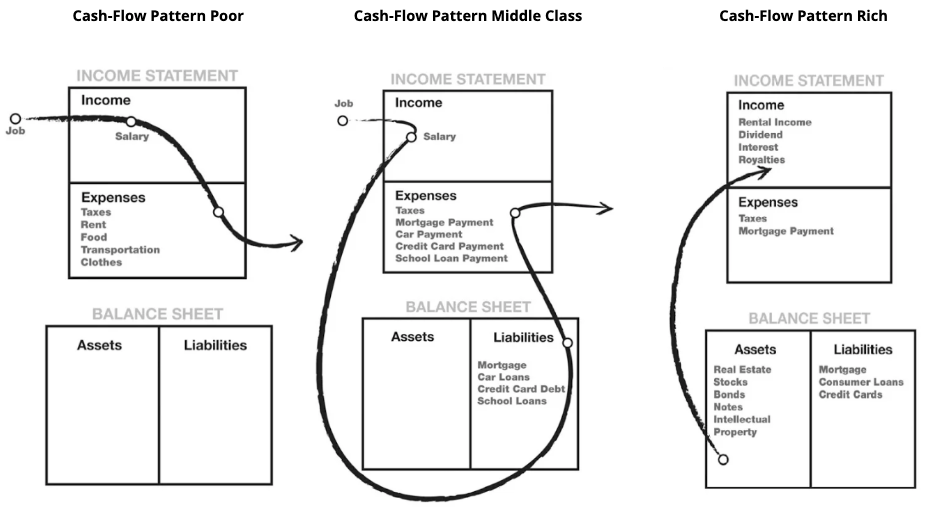

While this concept may seem straightforward, embracing it requires a shift in mindset and a commitment to building wealth. In essence, an asset is any resource that generates income, such as real estate investments, stocks, bonds, businesses, or other revenue-producing products. Conversely, a liability is something that drains money from your pocket, such as mortgages, loans, credit card debt, or depreciating items like cars. To achieve financial independence, you must prioritize growing your asset column, diversifying your income streams, and reducing dependence on a single source, such as your wage.

A particularly thought-provoking element of this distinction, as presented by the author, is the unconventional classification of a Home. He challenges popular dogma by arguing that a house often functions as a liability, a perspective that ignites debate. This viewpoint is enriched by the contrasting philosophies of his “two fathers”: Rich Dad, who regarded a house as a liability, and Poor Dad, who viewed it as his most valuable investment.

While the dream of Homeownership carries deep emotional resonance, the author isn’t discouraging the purchase of a home. Instead, he points out that homeownership comes with ongoing costs—maintenance, taxes, and mortgage payments—that take money out of your pocket.The key here is to set aside emotional biases and recognize the practical distinction between Assets and Liabilities. This understanding is vital to challenging conventional wisdom. A person with a “Rich” mindset focuses on acquiring assets, while someone with a “Poor” mindset may unknowingly collect liabilities, mistaking them for assets due to a lack of financial education. Developing this clarity is key for building lasting wealth.

Mind your Own Business

Building on this principle, Kiyosaki suggests that you learn to Mind Your Own Business. Basically this doesn’t mean that you should start a business, but that you focus on the Assets column and not the Income column. In other words, focus on acquiring genuine assets—those that hold value, generate income, appreciate over time, and can be traded in the market. Avoid liabilities or personal items that diminish in value the moment you purchase them. For instance, a new car loses nearly 25% of its value as soon as it leaves the dealership. Similarly, a salary increase does not align with the idea of Minding Your Own Business unless that additional income goes to real assets as described above.

To wrap things up, take your time to think over key concepts and let’s dig into fundamental questions. You can also find someone who shares your thoughts with, discuss following questions and form new ones: Have you received Financial Education before? How do you interpret the idea of Minding Your Own Business? Can you clearly distinguish between Assets and Liabilities?

See you on my next Post!

Fancy Reading the Full Work?

DISCLAIMER:

This site uses affiliate links which may earn a commission for purchases at NO additional cost to you. This helps us to continue creating content and support our community. We test each product thoroughly and give high marks only to the ones that are the very best. We are independently owned and the opinions expressed here are our own. Please only buy them if you feel they will help you achieve your goals, otherwise do not send any money.